One of the biggest economic crises ever witnessed in history was sparked off by the fall of Lehman Brothers. Manufacturing activity in the United States (US) hit a twenty-six year low. Prices paid by manufacturers in the US to their subcontractors fell to their lowest levels since 1949. All these indicators show that the US economy is entering a phase of unprecedented slow down. With more than five-lakh Americans losing jobs during the month of November 2008 alone, the corporate world is worried about the current recession in the US turning into something like the ‘Great Depression’ that was seen during the early 1930s.

History of Recessions & Business Cycles

Business cycles and how economies and companies behave during such business cycles have been extensively researched by academicians. Classical business cycles can be defined as recurrent, alternating phases of expansion and contraction in economies. Such expansion and contraction would be measured through a host of economic indicators such as economic output, Gross Domestic Product, consumption, prices, investment, employment, etc. A textbook definition of the term recession states that it is a period of general economic decline, more specifically a decline (negative growth) in the country’s Gross Domestic Product for a period of more than two consecutive quarters. Many other economic indicators like employment, industrial production, real income and wholesale-retail sales are also generally considered in assessing recession. Depression is nothing but severe recession, deeper in impact and longer in terms of time span. Some economists define Depression as a period during which the country’s GDP declines by more than ten percent. Alternatively, others describe Depression as a scenario when the country’s GDP declines consecutively for more than four quarters.

Prior to the current recession that commenced during December 2007, the last two recessions seen globally were during 2001 and 1990. Past history of recessions indicates that most of them have not lasted more than a year, except for two of them; in fact, the last two lasted just eight months each. Analysts however expect the current slow down in the economy to continue at least till mid 2009, which would mean that this recession could well be the longest recession in the history of the USA since the Great Depression of the 1930s.

The US is in recession! Is a Depression far away?

Yes, the USA is formally under recession, and the question now raised by many analysts is whether there is a possibility of this recession taking the shape of a depression, as was seen during the early 1930s. Technically, as we have seen, there are varied definitions as to what a recession is and what depression is; two key indicators widely accepted as reflective of the magnitude of recessionary impact are the rate of unemployment in the economy and the Gross Domestic Product (GDP) growth. During the early 1930s unemployment had touched twenty five percent and the GDP growth rate had nose dived to a negative thirteen percent. Compared to the thirties, the current crisis has recorded an unemployment rate of only around seven percent so far. Also, GDP growth rate in the global economy in the face of the crisis may well be negative but is not likely to cross half a percentage point. Though we need to factor in the fact that if the big three US auto majors (General Motors, Chrysler and Ford) wind down, unemployment rates could significantly increase, it still does not seem likely that it would be close to what was seen in the thirties. Therefore, most analysts are of the opinion that the current crisis may not evolve into a depression.

From an Indian historical perspective, the Indian economy has gone through twelve phases of recessionary cycles during the four decades commencing 1960. The time spans, or length, of the Indian business cycles have averaged over six years, with recessionary phases lasting for just less than a year on an average and expansions for just over five years.

How have countries reacted to the recessionary pressures in 2008?

It has been a challenging task for the United States (US) to take control of and manage this financial catastrophe, not only because the country has been the epicenter of the financial crisis, but also due to the fact that the government in the US is under transition. In spite of this, the US has quickly put together and approved a $700-billion package that will go to jump start the American economy. Out of this approved fund, the treasury department has injected around $150 billion into the banking system in the form of equity capital to more than fifty institutions. Now since these banking institutions are flush with such funds, it is for them to start lending more, so that cash reaches the credit worthy consumers and businesses, who in turn could jumpstart consumer spending that will boost the economy. Together with the US Fed, the Treasury department is also pumping an additional $200 billion into the financial system encouraging eligible consumers to avail of consumer loans in the nature of car loans, credit cards or student loans. The US Fed is also in the process of capitalizing and allocating funds to Fannie Mae, Freddie Mac and Ginnie Mae, the focal government-backed financial institutions that lend money to consumers for home ownerships. In effect out of the $700 billion, the current government has actually spent close to $350 billion; the balance may lapse, and would be at the disposal of the new government to spend. In addition, several options are being debated regarding revival of the US auto industry and more specifically, bail-out of the Big Three US auto majors. A temporary relief package of $25 to $50 billion is being contemplated, which would be followed by a comprehensive, larger, bail-out package during early 2009. Thus, the primary issues that the US is focusing on are:

- revamping and strengthening the Financial Sector,

- ensuring that sensitive sectors like auto remain afloat so as not to further erode consumer confidence

- revitalizing consumer spending such that the economy gets back to its feet.

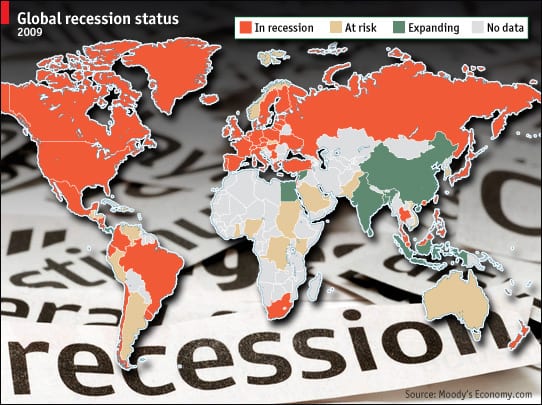

Having outlined the US response to the recession, let us further review how other continents and nations are gearing up to face the downturn.

Canada

The Canadian economy, being one of the richest in the world has been deeply impacted due to its proximity to the US; however due to its proactive responses, it is well positioned to face the crisis ‘head-on’. The Bank of Canada cut interest rate by half a percentage at the right time, coordinating with other central banks and has also attempted to ease the credit crunch by pumping in more than US$20 billion into the Canadian banking system. It is prepared to ease liquidity further if the situation so warrants.

South America

The South American countries, due to their proximity and trade relationships with the US, have been hit hard. Argentina, in spite of being rich in resources with well qualified human resources, has taken a deep hit from American recessionary pressures. The government is already putting in place a host of initiatives and policies that will minimize this impact on the country’s economy. The primary focus has been to avoid large scale job losses for which the government is closely working with the businesses. Higher tariffs have also been imposed on imports and trade barriers have been erected which will go to protect the national companies. Brazil is in a comparatively strong position, mostly due to its large natural reserves (especially of iron ore) and self sufficiency in crude oil. The country has embarked on a phased reform programme over the last two decades and has gained reasonable financial stability, due to which the impact from this crisis has been minimum. But even so, the Sao Paulo exchange stocks have been battered in the aftermath of this crisis. Mexico is spending more than $4 billion on infrastructure and energy projects to boost the economy. The country’s currency, peso, is under tremendous strain in the aftermath of the crisis.

The United Kingdom and Europe

The United Kingdom is famous for its services sector and is rated as the largest financial centre in the world. The government infused close to $65 billion into some of the world’s largest banks including the Royal Bank of Scotland (RBS), which received close to $20 billion. Barclays would receive more than $10 billion and Lloyds TSB would receive more than $15 billion.

Looking at some other countries in the Europe, Austria has had a robust growth rate over the last few years and has maintained a strong export position. The Austrian government has offered more than $100 billion in guarantees to the banking system and pumped in funds worth more than $20 billion in the form of equity capital. Sovereign guarantee (guarantees by the government of the country, considered as the highest guarantee possible) has also been extended on the personal banking side so that consumer and investor confidence could prevail. Consumer confidence in both France and Germany are at all-time lows. Business confidence in Germany, the largest economy of the European Union, has dropped to a fifteen-year low. France too has been hit hard by the recession. Economic growth has been sluggish and unemployment levels high. A $55-billion stimulus package has been put together which will extend equity financing to the French financial institutions and more than $400 billion in bank guarantees by the government. The German parliament has approved a financial package worth almost $700 billion that will guarantee troubled banks and personal deposits.

Ireland was in fact the first EU member to guarantee the deposits of its citizens.

Italy also put together a generous stimulus package and guaranteed deposits.

Switzerland, a country that has grown on the back of a strong financial sector faced serious trouble as a result of the crisis. The Swiss government bailed out its largest bank UBS by injecting equity of more than $5 billion in exchange for a ten percent equity stake in the bank.

In Belgium, one of its large banking groups Fortis, which recently acquired ABN Amro, was supported by the government to ensure its survival.

The Danish government has also provided large scale guarantees to its depositors.

Australia

The Australian government has injected more than A$7 billion into its financial system and has coordinated steep interest rate cuts; it is also in the process of extending sovereign guarantee to deposits in banks and financial institutions with an objective to increase consumer confidence.

China

The world’s fastest growing economy, China, is facing a unique problem. The country, which has always been outward focused and has been prospering on the back of spiraling exports and specializing in production of cheap goods, suddenly finds itself staring at a sudden vacuum in the global demand for goods and services. Unfortunately, the Chinese society is not given to large levels of consumption of goods and services, so that the drop in global demand could be compensated by increased demand within the local Chinese economy overnight. This anomaly has led to strained relationships with its global trade partners, especially the US, with whom it is running a huge trade surplus; with the US economy suffering from serious slow down, China’s problems have become multifaceted. It is predicted that China’s growth rate will be far less than the double-digit growth rates it has been achieving in the recent past, but would still be much higher than the Western counterparts. China did respond to the crisis with a marginal cut in interest rates, but has put together a stimulus plan in the nature of swaps and duty drawbacks that is expected to jump-start the slowing economy. Hong Kong, now part of China, has also cut interest rates and has guaranteed all bank deposits for the next two years.

Japan and the Far East

Japan, a country which has just come out of a decade-long national recession, is struggling in the midst of the current crisis. The government is contemplating fund injection in the form of equity capital into the business houses. A stimulus package of close to $18 billion has been approved and the Japanese Central Bank has injected more than $40 billion into the banking system.

Other Far-Eastern countries are doing their bit to revive their economies. Malaysia, for example, thrives on exports, especially tourism, electronic products, rubber timber and palm oil but the current sharp decline in global demand has had a serious impact on its economy. The government has tried measures to boost local consumption and demand through a series of measures and has also offered to guarantee all bank deposits for the next two years. Singapore, widely accepted as the financial capital of the far-east, has been unable to stimulate activity since much of the financial business within the country is actually driven by foreign investment, which has dropped. South Korea has focused on streamlining and strengthening its financial markets with the government extending its sovereign guarantee to the foreign currency borrowings of the country’s business houses. Additional liquidity has been injected into the banking system and a series of interest rate cuts implemented.

Indian response to the global recession

The Union government of India recently approved a US$8-billion (Rs.32000-crore) package to strengthen its economy. This package included a reduction in excise duty to the tune of four percent covering consumer durables, cars and cements; interest rate subsidies and boost to infrastructure investments. Interest rate was also cut by more than a percentage point, intended to counter the downward trend in the economic cycle. However, the industry bodies were not pleased with the magnitude of government action in stimulating the economy. Business expected more initiatives and tax sops, especially in the real estate sector, which would stimulate the economy to perform better. Also the interest rate for the home loan sector was only very briefly touched upon in the package, which, according to many analysts is the most critical in the present scenario.

Is the Indian economy in recession? Going by the technical definition of recession, which stipulates that the economy should decline continuously for more than two quarters, the Indian economy is not even close to any kind of recession; what India is concerned about is whether she would grow at 8% or 6% and there have been no questions of negative growth. Hence we could define India’s current situation as a period of economic slow down, rather than as recession. It is critical for India to address the issues of concern in this period of slow down. The fact that industrial growth is under serious pressure is a point of concern. The latest economic data for October 2008 has shown that India’s industrial production has grown negatively, by 0.4%, for the above month as compared to the corresponding period in the last year. October 2008 has seen a period of severe decline in economic activity driven by global and local slow down, and the government of India claims that this is the first instance of decline in industrial production over the last fifteen years. The demand for products across the board – fast moving consumer goods, retailed grocery, cars, scooters, two wheelers, housing – has sharply fallen resulting in weak consumer spending. Bank loans have also been curtailed and interest rates are heavy so that it does not give any incentive for investors to avail bank loans to finance their home and auto investments.

It is not only the drop in domestic and global demand, but also the lack of liquidity in the financial system, and more specifically the unavailability of free funds from the banks to companies, that has choked corporate entities and led them to cut production in large scale. Automobile companies, both in four-wheelers and two-wheelers, are working only around three days a week and production has been significantly slashed down. Hence, there has been a double whammy with reduced demand and shortage of products and services in the markets. This slow down in industrial production has also resulted in a major decline in exports out of the country; imports on the other hand have been increasing steadily, exerting pressure on the country’s balance of payment situation.

The government has assessed that given this grim situation, the projected growth for the current fiscal year 2008-09 will be very discouraging and nothing close to 8%, or even 7%.

To conclude, one could recall that the global economy successfully tided over even the ‘Great Depression’ during the 1930s; there is no doubt that it will do so this time as well. But having seen the impact of the American recession on economies across the world, and having also noted the initiatives of various countries in minimizing this impact, it would be interesting to wait and watch how the global economy fares over a longer term future, say over the next two decades.

Leave a Reply

You must be logged in to post a comment.